The focus of this assessment is to ascertain if your Company is prepared for the Federal COVID-19 mandatory requirements effective April 1, 2020. Employers that do not comply with the new law may be liable to unpaid wages, damages, attorney fees, and reinstatement.

COVID-19

☐ Is your Company under 500 employees (including part-time, temporary, leased, and shared employees)? If you are over 500 employees, have you investigated your state laws?

☐ Have you posted the mandatory Federal notice for COVID-19? Employers are allowed to post electronically or by mail to each employee.

☐ Have you planned for the employee mandatory 80-hour COVID-19 sick pay (sunset 12/31/2020)?

☐ Have you prepared for the employee mandatory COVID-19 FMLA? Do you know the legal requirements?

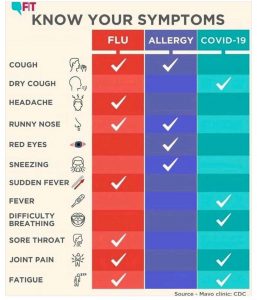

☐ Have you developed the COVID-19 employee assessment?

☐ Has your group health plan complied with the COVID-19 law? Have they covered the COVID-19 testing?

☐ Do you know the tax credits when you abide by the COVID-19 rules?

☐ Has your payroll system been reconfigured to track both the COVID-19 sick pay and the COVID FMLA?

☐ Have you communicated to your employees regarding COVID-19 compensation and COVID-19 FMLA under the law?

☐ Have you communicated to your employees regarding new unemployment insurance pay and process under the law?

If you have any questions about this new law, contact us.

Reference: SHRM.org, Mayo Clinic