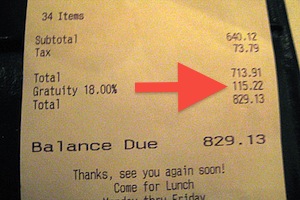

Starting in January 2014, the Internal Revenue Service will begin classifying automatic gratuities, which restaurants often add to the bills of large parties, as service charges to be treated as regular wages subject to payroll-tax withholding. Service charges differ from tips, which dining establishments rely on employees to report as income (according to the IRS, servers who receive cash tips of $20 or more in a calendar month are required to report to their employer the total amount).

Starting in January 2014, the Internal Revenue Service will begin classifying automatic gratuities, which restaurants often add to the bills of large parties, as service charges to be treated as regular wages subject to payroll-tax withholding. Service charges differ from tips, which dining establishments rely on employees to report as income (according to the IRS, servers who receive cash tips of $20 or more in a calendar month are required to report to their employer the total amount).

The change was announced in an August 2013 IRS ruling, Topic 761–Tips–Withholding and Reporting. The ruling goes beyond last year’s Revenue Ruling 2012-18, which dealt with taxes imposed on tips and service charges but did not address automatic tipping.

The change could have eateries rethinking their policies, attorney John Riccione, co-managing member at Chicago-based law firm Aronberg Goldgehn, told SHRM Online. “The new regulation will mean more paperwork and added costs for restaurants that use automatic tipping,” he noted.

“Automatic tipping was originally implemented to ensure waitstaff were compensated for large parties,” Riccione explained. “With the new requirement, restaurants will have to factor the service charge into the hourly pay rate. This means automatic tips are subject to payroll-tax withholdings.”

The IRS ruling highlighted the involuntary nature of automatic tipping as the key issue. “If it appears the customer has no say as to what the proper gratuity should be, it falls under the service-charge category,” said Riccione. He predicted “many restaurants will repeal the practice to avoid the added cost” of tax withholding, leaving servers to face the risk of being stiffed.