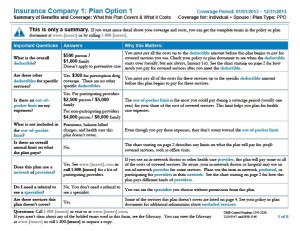

Beginning the first day of the open enrollment period beginning on or after September 23, 2012, employers who provide group health plans must provide a Summary of Benefits and Coverage (SBC). The SBC is a government document mandated by the new Health Care Reform Act (PPACA) to document covered benefits, cost-sharing provisions, coverage limitations and plan exceptions. (Attached is the document required). The PPACA is a complex law and below are just a few implementation tips for employers:

Beginning the first day of the open enrollment period beginning on or after September 23, 2012, employers who provide group health plans must provide a Summary of Benefits and Coverage (SBC). The SBC is a government document mandated by the new Health Care Reform Act (PPACA) to document covered benefits, cost-sharing provisions, coverage limitations and plan exceptions. (Attached is the document required). The PPACA is a complex law and below are just a few implementation tips for employers:

- The SBC sent to an address in a county where at least 10 percent of the population primarily speaks the same non-English language, the plan or employer must provide oral language services in that non-English language and provide notices upon request in the non-English language.

- The employer or issuer must include in all English SBCs a statement in the non-English language clearly indicating how to access the language services provided by the employer or issuer. The language-services statement should be added to the SBC page containing the “Your Rights to Continue Coverage” and “Your Grievance and Appeals Rights” sections.

- The SBC must show both individual and family deductibles (i.e. prescription drugs – Individual $100, Family $200)

- The SBC must show separate out-of-pocket limits for in-network and out-of-network. (i.e. Individual $1,000, Family $2000 for participating providers; Individual $2,000, Family $4000 for nonparticipating providers).

- The SBC does not have to provide a statement about grandfathered or non-fathered status.

- Employers should insert the coverage period of the plan (i.e. coverage beginning on or after 1/1/2013).

- The SBC must be sent seven (7) business days from being requested.

- Employer plans are permitted to include “add-on” benefits on the SBC. The add-ons should be shown in the appropriate spaces on the SBC for deductibles, copayments, coinsurance, and benefits not covered by the major medical coverage.

Reference: shrm.org – Health Care Page